The Modern Way To Transact

Renewable Energy

Technology that renewable energy buyers and sellers trust to secure fast, hassle-free, and high-value deals.

Daily tracking

Daily tracking

By tracking the market every day, our statistics show that you can add 10-15% extra value to your renewable energy deal.

Be in control

Be in control

Take charge of your own quotes and tenders with our user-friendly tools.

Customer service

Customer service

As one of the nation's most trusted PPA marketplaces, we go the extra mile - helping you every step of the way.

The proof is in our customers' words

Angus T

St Fergus Wind Farm

Working with PPAYA has allowed us to collaborate effectively and efficiently with big energy suppliers. I want to thank the PPAYA team for their competent knowledge within the sector and the extensive contract negotiations that have taken place that led to our PPA deal getting over the line.

Oliver K

Bagley Biogas

The PPAYA portal is an excellent, user-friendly management tool, and having PPAYA constantly monitor energy prices for us and securing contracts at good prices for our power has been hugely advantageous in such a volatile market.

Charlie B

Booth Brothers Energy Ltd

The regular communication is brilliant, and I appreciate the daily updates to stay on top of the markets every morning. I honestly can't fault them.

Simon E

Lark Fleet Smart Homes

Joel and PPAYA were a pleasure to work with and managed to secure a decent deal for my next year's export. Even though we only have a small solar farm, I never felt this was a hindrance to the level of care and support I received from them.

Proudly recognised by

Our commitment to renewable energy has been acknowledged and awarded by prominent industry organisations, including Forbes, ADBA, and the REA.

Winner

AD and Biogas Industry Awards Rising Star 2023

Winner

Solar and Storage Live Start-Up of the Year 2023Proudly recognised by

Our commitment to renewable energy has been acknowledged and awarded by prominent industry organisations, including Forbes, ADBA, and the REA.

Stay Updated

From market analysis and policy shifts, to industry news and technological developments, our blog will keep you updated on all the latest industry insights and opinions.

PPAYA

PPAYA Launches A New Electricity Procurement Platform!

After months of meticulous planning and development, we are excited to announce the official launch of our new electricity procurement platform. Acknowledging the difficulties that electricity consumers and renewable generators encounter with traditional procurement processes, we have developed a platform that automates the entire workflow, making it simpler for all parties involved. For energy consumers, our platform streamlines clean energy procurement by consolidating all processes in one place and reducing the number of administrative tasks. For renewable generators, our platform makes it easier for them to supply their clean energy to businesses in a competitive and transparent way. #### **The Energy Procurement Platform** Our new platform allows electricity consumers to procure green energy directly from local generators in just five simple steps: 1️⃣ Register for an account 2️⃣ Upload information 3️⃣ Select the percentage of your electricity that you want to be sourced from renewables 4️⃣ Receive offers with the best-matched generators 5️⃣ Choose the offer best suited for your business needs #### **Consumer Benefits** ### **Carbon Savings** Using your consumption data, we can accurately calculate your carbon savings with official carbon reporting standards. This precise measurement helps you track your environmental impact and provides a clear picture of your progress towards reducing carbon emissions. ### **Time-Stamped REGOs** We can provide time-stamped REGO certificates that are matched to each hour of consumption, including the time and date of creation and issuance. These time-stamped REGOs improve the accuracy of your energy reports, ensuring detailed and reliable documentation of your renewable energy consumption. ### **Reaching Sustainability Goals** Our platform streamlines the process of procuring green electricity, making it a viable tool to incorporate into your company’s ESG strategy. Combined with our expert team, PPAYA can help you incorporate renewable energy into your operations and support you in reaching your sustainability goals. ### **Reduction in Electricity Bills** Securing renewable electricity at a fixed price can lead to potential financial savings of around 10-15% compared to purchasing directly from the grid. By choosing clean energy for your business operations, you not only contribute to environmental sustainability but also benefit from significant cost reductions. _As part of our service to PPAYA Ltd. platform members, we are pleased to provide you with a detailed market report, highlighting all key updates and market changes, indicating how this will affect the coming days/weeks ahead._ _Sign up to our platform for free today to keep up to date with these changes and discover more about how we can help you secure the best price for your Power Purchase Agreement._

by Stephen Jude

September 20, 2024

3 min read

Renewables

GDuoS (Embedded Benefits) Price Changes for 2025-26

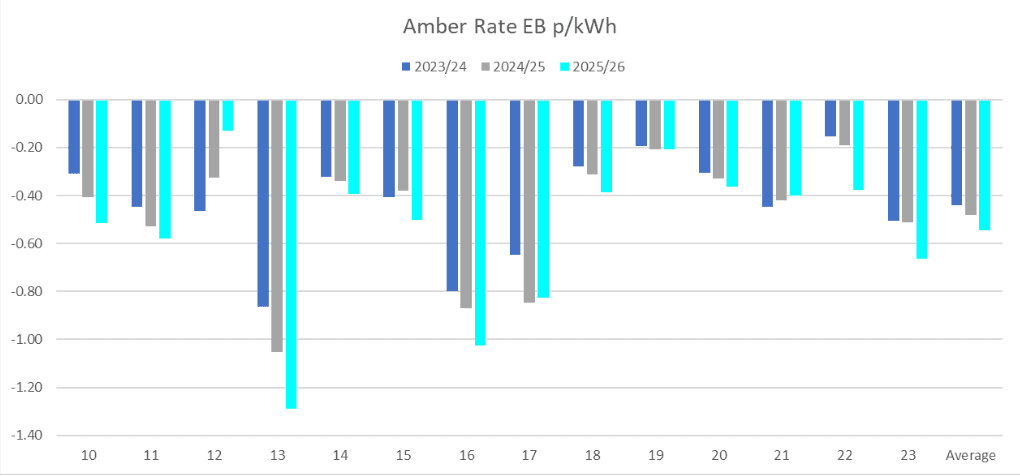

Generation Distribution Use of System (GDuoS) prices for the 2025-26 year have been released by all Distribution Network Operators (DNOs), and there is a notable forecasted increase in embedded benefits across UK Grid Supply Point (GSP) regions. In this blog, we’ll explore embedded benefits in the UK electrical network, GDuoS charges, Red, Amber, and Green (RAG) rate charges, along with visual presentations of the changes between 2023/24, 2024/25, and 2025/26 years. #### **What are Embedded Benefits?:** Embedded benefits are financial advantages that energy suppliers receive from having embedded generation in the electrical network. In this context, embedded generation refers to electricity supplied to the distribution network - providing electricity at the local level - rather than the transmission network, which supplies electricity nationwide. Network operators offer payments to energy suppliers, determined by the amount of embedded generation in the network. These payments serve as incentives, encouraging suppliers to continue developing and maintaining their embedded generation. #### **GDuoS Charges:** A primary component of these payments are the GDuoS charges. Typically, energy generators pay use-of-system charges to network operators for using the transmission and distribution networks. These charges are in place to recover the costs involved in transporting electricity over long distances, to which large, transmission-connected generators pay a high amount. Energy generators with embedded generation avoid some of these costs, as their energy is generated and consumed locally, thereby alleviating the strain on the wider transmission network. These generators pay reduced GDuoS charges, which can be interpreted as savings. Additionally, they receive payments from network operators in recognition of their embedded generation. #### **RAG Rate Charges:** RAG represent the different periods of electricity demand in the UK. The red category signifies the highest or peak demand, amber for moderate, and green for periods of low demand. GDuoS charges applied to each of these demand periods are referred to as RAG rate charges, and these charges highlight how the timing of embedded generation and consumption can have significant financial implications. #### **Embedded Benefits Across The 2023-24, 2024-25, and 2025-26 Periods** Provided below are analyses and graphs of embedded benefits for RAG rate charges, measured in pence per kilowatt-hour, across various geographical areas within the distribution network (GSPs), designated by the numbers 10 to 23. The chart compares three fiscal years: 2023/24, 2024/25, and the recently released 2025/26, each colour-coded to distinguish the data for each year. The values are plotted on the y-axis and they are all negative, which represents a rebate or reduction in network charges that suppliers receive for embedded generation during the three RAG rate periods. For each GSP region, there are three bars showing the value of the embedded benefit for each of the fiscal years. The consistent presence of negative values across the GSP regions suggests that all areas are experiencing some form of embedded benefits. #### **Red Rate Charges:**  For embedded generators, generating power during these red periods can be particularly beneficial. By supplying electricity when the demand (and the price) is at its highest, embedded generators can offset these peak charges significantly. For the current year, embedded generators are set to receive an average of 4.1p/kWh (£41/MWh) in savings, increasing to 4.81p/kWh (£48.1/MWh) for 2025-26. #### **Amber Rate Charges:**  Embedded generators operating during amber periods still have their benefits, though not as pronounced as during red periods. By contributing to the energy supply during these times, embedded generators can help stabilise the network and reduce the need for expensive energy imports or activation of peaking power plants. For the current year, embedded generators are set to receive an average of 0.48p/kWh (£4.8/MWh) in savings, increasing to 0.55p/kWh (£5.5/MWh) for 2025-26. #### **Green Rate Charges:**  During green periods, the benefit of embedded generation is drastically less in terms of cost savings. For the current year, embedded generators are set to receive an average of 0.07p/kWh (£0.7/MWh) in savings, increasing to 0.08p/kWh (£0.8/MWh) for 2025-26. Of particular note is GSP 17 in the Scottish Highlands, which receives over three times the average rebates compared to the others. This is significant, considering the limited transmission network in the highly rural area. As presented in the above graphs, embedded benefits for the 2025-26 year are, on the whole, more generous than those granted in the current and previous periods, as indicated in the averages column. For all demand periods, RAG rates have been significantly boosted across the GSP regions, highlighting the incentive for renewable energy generators to supply their electricity at the local level instead of the transmission network. Overall, the interaction between embedded generation, RAG rate charges, and GDuoS charges highlights the complex and dynamic nature of energy pricing and the incentives designed to promote more efficient and sustainable energy usage. These mechanisms encourage not only the adoption of local generation solutions, but also intelligent energy management practices that align with the varying demand and pricing structures of the electricity grid. _As part of our service to PPAYA Ltd. platform members, we are pleased to provide you with a detailed market report, highlighting all key updates and market changes, indicating how this will affect the coming days/weeks ahead._ _Sign up to our platform for free today to keep up to date with these changes and discover more about how we can help you secure the best price for your Power Purchase Agreement._

by Stephen Jude

September 25, 2024

5 min read

Renewables

Hydro and Intergenerational UK Energy Security

Hydropower, which boasts a low carbon footprint and can operate for over 150 years with refurbishment, has a generation profile well matched to the UK’s energy demand and has the capability to become a cornerstone of UK energy security. However, as the government prioritises quantity over longevity, favouring projects with the cheapest kWh, funding and support have disproportionately flowed towards solar PV and wind, while hydropower has consistently been overlooked. In this blog, we will explore hydropower technologies and their potential to establish robust, domestically sourced energy security for the UK. #### **Hydropower: Consumer & Environmental Benefits** Hydropower, among the oldest and largest renewable energy sources, [contributed 16% of the world’s total electricity in 2022 according to TheEngineer ](https://www.theengineer.co.uk/content/opinion/comment-hydropower-is-the-forgotten-giant-of-the-energy-transition#:~:text=It%20currently%20generates%2016%20per%20cent%20of%20the%20world’s%20total%20electricity)- comparable to the combined output of wind and solar for the year. In the UK, there are over 1,650 Run of River (RoR) hydropower schemes amounting to 2GW of installed capacity. This year, hydropower produced almost 3TWh of electricity, or around 1.3% of the UK’s generation. [A recent report by Biggar Economics](https://www.british-hydro.org/biggar-economics-report/) estimated that existing hydropower reduced the wholesale electricity cost for UK consumers by £275 million in 2019; in 2022, this increased to £1.1 billion, with an average of £200,000 reductions on wholesale costs at 5pm every day. Furthermore, the same report estimates that hydropower has prevented the emission of 160 million tonnes of carbon dioxide since 1920. #### **Pumped Storage Hydro (PSH): Reliable Energy Storage** PSH functions as a versatile and alternative energy storage solution involving two reservoirs at different elevations. In times of low energy demand, excess electricity is used to pump water to the higher reservoir; when demand surges, the stored water is released to produce electricity. Currently, the UK is home to four operational PSH schemes, featuring an installed capacity of 2.83GW, which, according to Rystad Energy, accounts for [more than half of the UK's installed energy storage capacity.](https://www.rystadenergy.com/news/charging-up-uk-utility-scale-battery-storage-to-surge-by-2030-attracting-investme#:~:text=Of%20the%204.7,the%20long%20term.) However, there have not been any more facilities of this ilk for almost 40 years, despite there being over 6.85GW ready to be built. These PSH schemes, all state-funded over 60 years ago, were initially designed to consume and store overnight generation from nuclear power plants, addressing their limitations in adjusting to the fluctuating profile of electricity demand. Now, as the share of intermittent renewables on the grid continues to rise, PSH can serve a vital role in balancing the grid. #### **Hydropower Left By The Wayside** Since the introduction of the CfD scheme, the government's key mechanism for backing new low-carbon power infrastructure, there haven’t been any successful bids for hydropower projects. In contrast, newer technologies such as solar PV and onshore wind continue to see success, with the latest auction [yielding 24 onshore wind and 56 solar PV projects.](https://assets.publishing.service.gov.uk/media/64fa0473fdc5d10014fce820/cfd-ar5-results.pdf) Three fundamental factors contribute to the subdued investor confidence and limited bids for hydropower projects. Firstly, the current 5MW minimum installed capacity requirement for hydropower projects has impeded the participation and funding prospects of numerous smaller capacity sites in the pipeline. Secondly, the government currently compares hydro with solar and wind in terms of installed capacities and cost competitiveness. In reality, it should be considered as a replacement for high fossil fuel generation methods such as coal and gas peaking plants. Lastly, and arguably the most critical concern, is the lacklustre strike price caps set at each auction. From the first auction to the latest, the strike price has consistently dwindled, falling from £100/MWh (£145 in 2023 inc. inflation) to £89/MWh (£129.6 in 2023 inc. inflation). Although there's a slight increase to £102/MWh (£148.53 in 2023 inc. inflation) in the recently revealed AR6 strike price caps, the British Hydro Association (BHA) has expressed a higher figure is needed to unlock the unrealised potential of British hydropower. #### **The Call For Supportive Action For Hydropower Development** [According to a report by Birmingham University,](https://research.birmingham.ac.uk/en/publications/uk-hydropower-resource-assessment-2022) the hydropower industry can deliver a further 1GW of reliable, winter baseload, low carbon energy generation if a price stabilisation mechanism of £140-180/MWh is implemented. The BHA have proposed a number of recommendations urging the government to introduce policy support that will allow for the deployment of 1GW hydropower, with the most important changes focusing on the government’s CfD schemes. This includes reducing the current 5MW minimum installed capacity to 1MW, allowing the aggregation of pipelines of projects, and setting a strike price at £160/MWh to enable these pipelines of construction-ready projects to begin building. Additionally, the BHA have called for the government to reconsider and properly evaluate the role of hydropower in replacing high fossil fuel generation methods such as coal and gas peaking plants, rather than comparing it on their cost competitiveness with wind and solar. #### **A PSH Pipeline Offering Intergenerational UK Energy Security** Similar to proposals for hydropower schemes, the right price stabilisation mechanism can help the existing PSH pipeline deliver an additional storage capacity of around 135GWh to the UK Grid within the next 10 years. With [daily curtailment costs of up to £62 million](https://www.nao.org.uk/wp-content/uploads/2023/03/decarbonising-the-power-sector-summary.pdf) and an anticipated rise in the cost of managing network transmission congestion to £3 billion per year, the PSH pipeline would offer substantial relief and savings by storing electricity close to the source, thereby preventing curtailment and providing flexible storage at optimal times. Additionally, as PSH is exclusively controlled and managed by the UK electricity market and system operator, the potential 135GW of additional storage would generate up to £14.8 billion for the UK economy, provide up to 253,700 years of employment, and domestic energy security for many generations to come. With the growing importance for grid flexibility and storage, it is imperative that the government reconsiders their stance and approach to other renewable energy technologies, especially hydropower and hydropower storage. Recognising it as an anchor asset could provide a robust backbone for supporting the country’s net-zero ambitions. _As part of our service to PPAYA Ltd. platform members, we are pleased to provide you with a detailed market report, highlighting all key updates and market changes, indicating how this will affect the coming days/weeks ahead._ _Sign up to our platform for free today to keep up to date with these changes and discover more about how we can help you secure the best price for your Power Purchase Agreement._

by Stephen Jude

September 25, 2024

6 min read

Stay Updated

From market analysis and policy shifts, to industry news and technological developments, our blog will keep you updated on all the latest industry insights and opinions.

Backed by